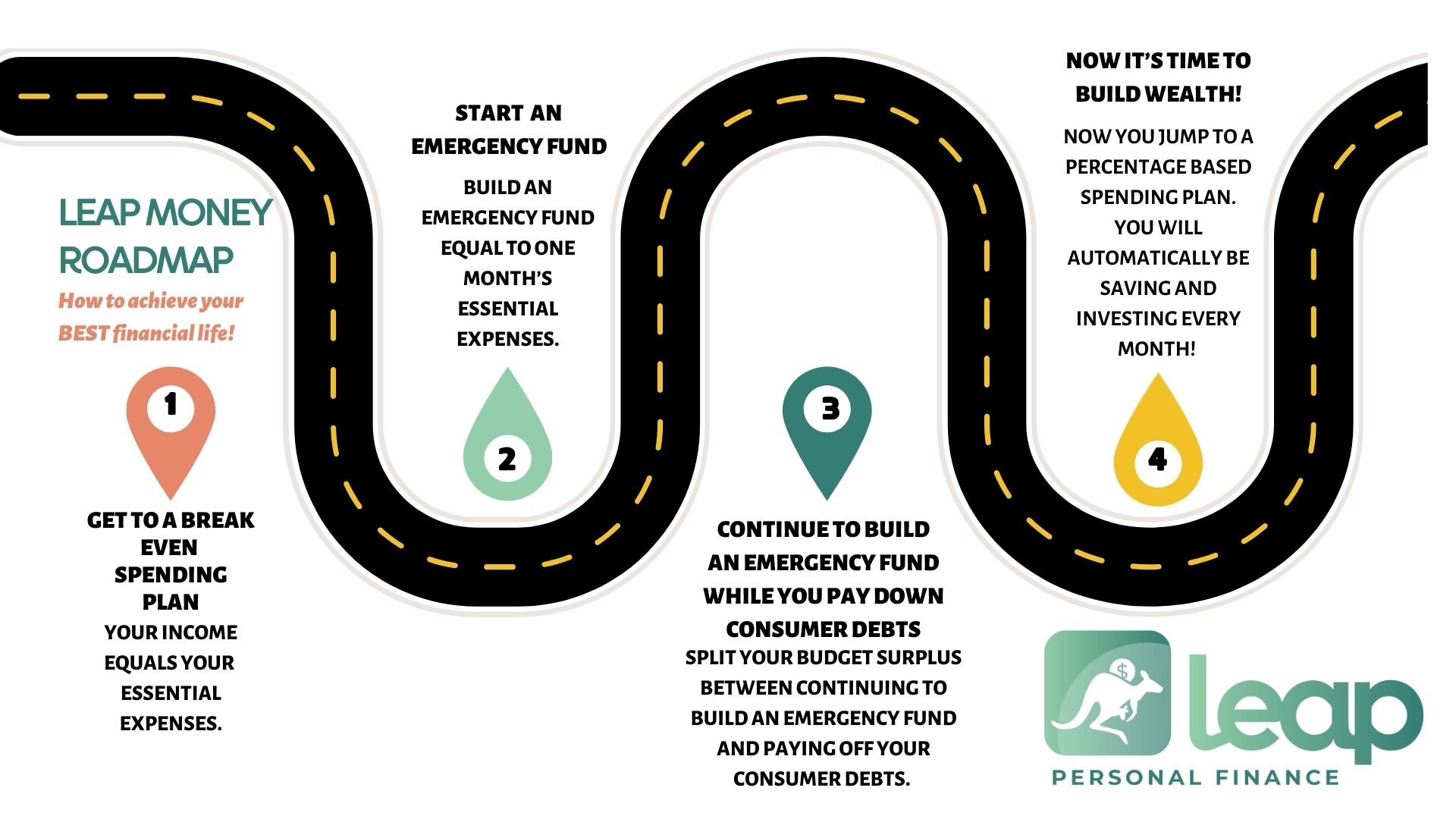

The Leap Money Roadmap:

4 Leaps to Financial Wellness!

Leap Goes Beyond Traditional Financial Literacy...

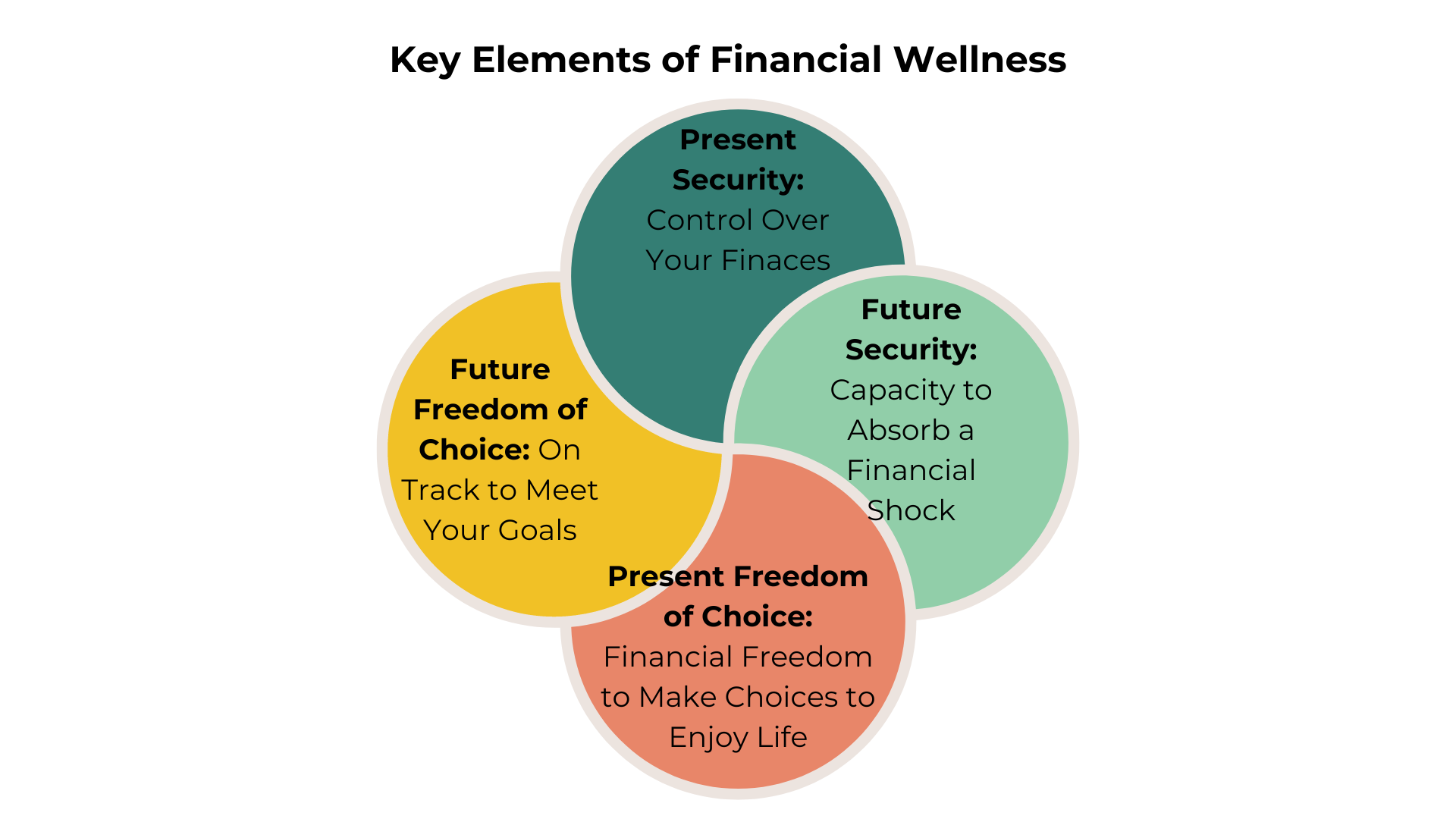

Leap’s key indicators of financial wellness—present security, future security, present freedom of choice, and future freedom of choice—are essential for a balanced financial life. They ensure that both current and future needs are met, providing flexibility and stability. For financially stressed new parents, these indicators are crucial in managing immediate expenses while securing a stable future for their family.

FAQ'S

Why Do Other Financial Literacy Programs Fall Short?

Traditional financial literacy programs often fall short because they focus solely on knowledge, neglecting the practical application and emotional aspects of financial wellness. These programs may not consider the unique needs and challenges of different communities, leading to limited impact. A holistically designed financial wellness program, integrated into a community organization’s existing efforts, addresses these gaps by providing tailored support, fostering real behavioral change, and creating a more sustainable path to financial empowerment. This approach ensures that financial education is relevant, accessible, and truly effective for those it serves.

What Information Is Included on the App?

Recognizing the time constraints and attention spans of expectant parents, the app delivers daily, bite-sized lessons on diverse financial literacy topics. This strategic design mirrors the way individuals engage with their

favorite social media platforms, fostering consistent and manageable learning. The cumulative effect is a gradual accumulation of financial knowledge, building a foundation of literacy that is not overwhelming but empowering.

Topics include:

Accessing Government Benefits, Income, Expenses, Creating a Spending Plan, Managing Credit and Debt, Improving Credit Scores, Budging for Baby, Consumer Skills, Fraud Awareness, just to name a few!

How Will Leap Help Us Enhance Our Current Services?

Integrating a financial empowerment program into an organization’s existing initiatives is a

strategic move that significantly enhances overall effectiveness. Numerous studies highlight

the positive correlation between financial empowerment and the success of various social

and community programs. According to a report by the Urban Institute, individuals who participate in integrated financial empowerment programs are more likely to experience

improved educational outcomes, increased employment stability, and enhanced housing

security.